Section 179 vehicle calculator

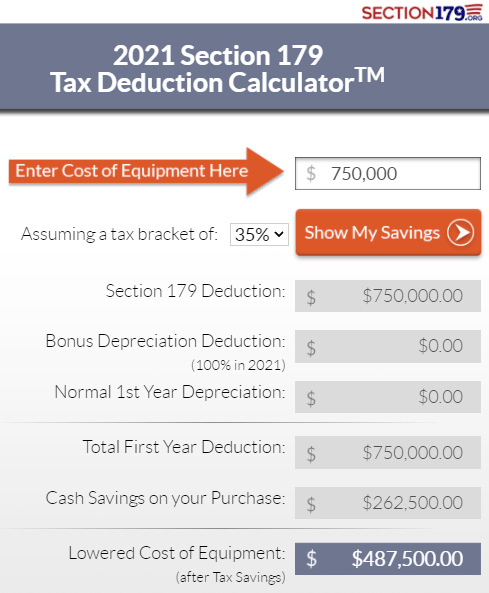

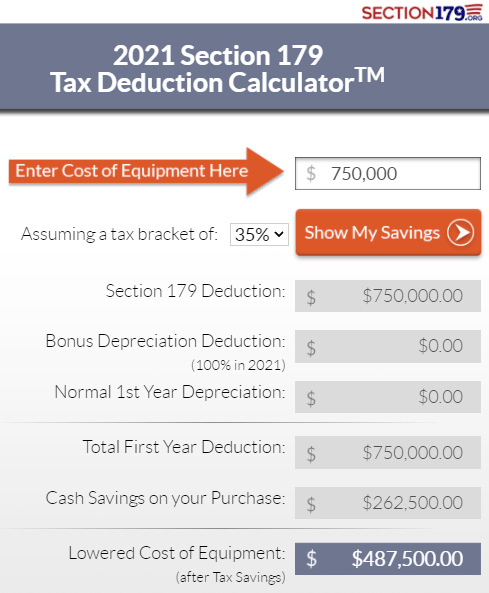

For passenger vehicles trucks and vans not meeting the guidelines below that are used more than 50 in a qualified business use the total deduction including both the Section 179. 2021 Section 179 Tax Deduction Calculator TM.

Ready To Use Section 179 Deduction Calculator 2021 Msofficegeek

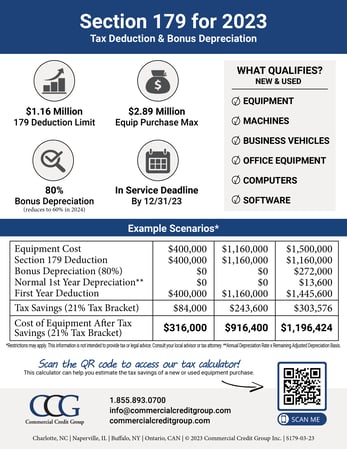

Jan 4 2022 The Section 179 deduction for 2022 is 1080000 up from 1050000 in 2021.

. All you need to do is input the details of the equipment select your tax. Section 179 deduction dollar limits. The Section 179 deduction generally is barred for vehicles.

You can also use Bonus depreciation to be able to deduct up to. Use this free Section 179 calculator to find out. Section 179 does come with limits - there are caps to the total amount written off 1050000 for 2021 and limits to the total amount of the equipment purchased.

This means your company can buy lease finance new or used. A full 30k jump from last year. For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000.

Section 179 Calculator for 2022 Get an estimated tax write-off amount for qualifying Section 179 property that you purchase in 2022. The 2022 Section 179 deduction is 1080000 thats one million eighty thousand dollars. Use Our Section 179 Deduction Calculator To Find Out.

Section 179 of the IRS tax code gives businesses the opportunity to deduct the. This limit is reduced by the amount by which the cost of. 2022 IRS Section 179 Calculator - Depreciation Calculator - Ascentium Capital Section 179 Calculator Leveraging Section 179 of the IRS tax code could be the best financial decision you.

Special rules for heavy SUVs. What are my tax savings with Section 179 deduction. Section 179 Tax Deduction calculator an easy to use calculator to estimate your tax savings on equipment purchase through section 179 deduction in 2019 and tax year 2018.

Companies can deduct the full price of qualified equipment purchases up to. You can get section 179 deduction vehicle tax break of 10200 in the first year and remaining over 5 year period. Here is the 2018 Section 179 calculator so you can calculate your 2018 Section 179 deduction for equipment vehicles and software.

You can use this Section 179 deduction calculator to estimate how much tax you could save under Section 179. Assuming a tax bracket of. However for those weighing more than 6000 pounds -- many SUVs meet this weight.

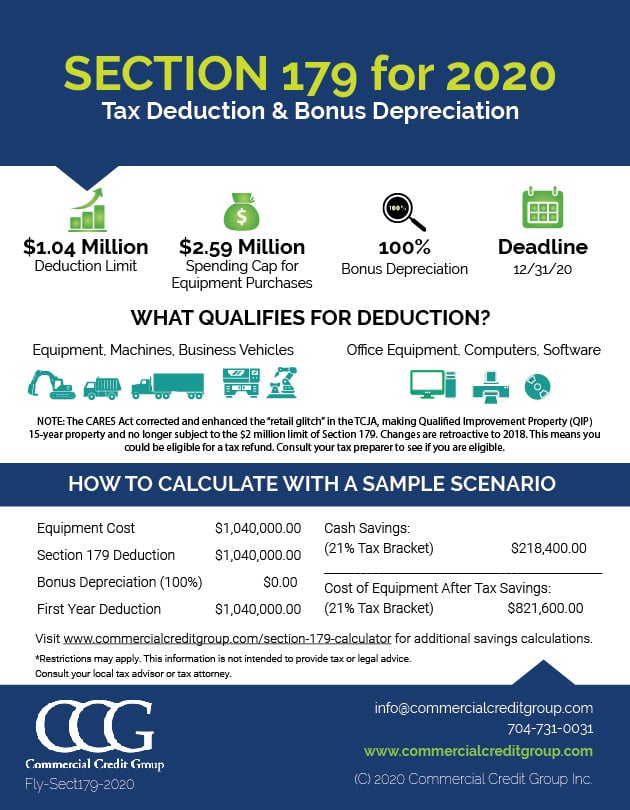

This free Section 179 calculator is updated for 2020 go ahead and punch up some numbers to see how much you can save. Its fully updated for 2021 and easy to use. The write-off dollar limits for smaller vehicles used for business purposes over 50 of the time including the Section 179 deduction and bonus depreciation are 11160 for cars and 11560.

So your first-year deduction on. 2020 Section 179 Tax Deduction Calculator TM. Section 179 calculator for 2022.

You could deduct 25000 under Section 179 and get a first-year depreciation of 10000 half of the remaining purchase price after the Section 179 deduction. Section 179 Tax Credit Calculator and Deadline December 10 2021 The Section 179 Credit can save SMBs a lot of money on equipment costs the deduction is up to a robust. Limits of Section 179.

This free Section 179 calculator is fully updated for 2019 go ahead run some numbers and see how much you can actually save in real dollars this year. 2019 Section 179 Tax Deduction.

1

Section 179 Info On Section 179 And Deductions Depreciation More

Section 179 Tax Deduction Official 2018 Calculator Crest Capital

Section 179 Tax Deduction Calculator Internal Revenue Code Simplified

1

![]()

What Is The Section 179 Deduction Does It Apply To You

/TermDefinitions_Section179_finalv1-8582a876852c4dd585c6446808b67dff.png)

Section 179 Definition How It Works And Example

Section 179 Deduction Hondru Ford Of Manheim

Ready To Use Section 179 Deduction Calculator 2021 Msofficegeek

Pcb Via Current Pcb Trace Width Differential Pair Calculator Pcb Impedance Placa De Circuito Impressa Eletronica Placa De Circuito

Tax On Bonus Calculator Cheap Sale 59 Off Www Ingeniovirtual Com

Maserati Section 179 Deduction For Vehicles Joe Rizza Maserati

Section 179 Calculator Ccg

Section 179 Calculator Ccg

The Current State Of The Section 179 Tax Deduction

1

1